KIVA

Crowdfunded Loans

Kiva x BUILD Institute

Kiva is a nonprofit that provides 0% interest, community-backed microloans to small business owners and entrepreneurs who may not qualify for traditional financing, particularly those from underserved communities. BUILD Institute is Kiva’s longest standing combined Hub/Trustee partnership. BUILD has worked with Kiva to continue to improve the Hubs model, create efficiency, and grow volume so that Michigan residents receive the benefits of this program.

How Kiva Crowdfunding Works

Apply: for a Kiva loan between $1,000 and $15,000, 0% interest, no credit requirements

Private Fundraising: Have 5 to 25 friends, family, and community members each lend you $25

Public Fundraising: Kiva’s international community of over 2 million lenders raise the remainder of your loan

Grow: Spend your loan to grow your business

Repay: Repay your loan in 12 – 36 months, all of your Private and Public Funders will get paid back as you pay back the Loan

About Kiva Loans

Download a Kiva Flyer

Local Kiva Borrowers

Vivacious Lady, LLC

$4,000 Kiva Loan

Ameiachrisaccessories

$3,500 Kiva Loan

Bright Child Care Center

$7,000 Kiva Loan

Jessica Blair Beauty, LLC

$9,500 Kiva Loan

Oh Fryz, INC

$8,500 Kiva Loan

Kuderik Brothers LLC

$6,500 Kiva Loan

BUILD Institute x Kiva

When Kiva brought its crowdfunding model to the US, Detroit was the first city a HUB was built in. BUILD Institute and Kiva have had a wonderful symbiotic relationship for the past decade plus. Kiva partners with local organizations around the US to help reach entrepreneurs on a more personal level. As of 2025 Kiva has 40 HUBs around the country. BUILD Institute offers support to entrepreneurs looking to get a Kiva loan around Michigan, particularly in Wayne, Oakland, and Washtenaw counties.

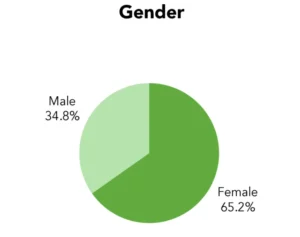

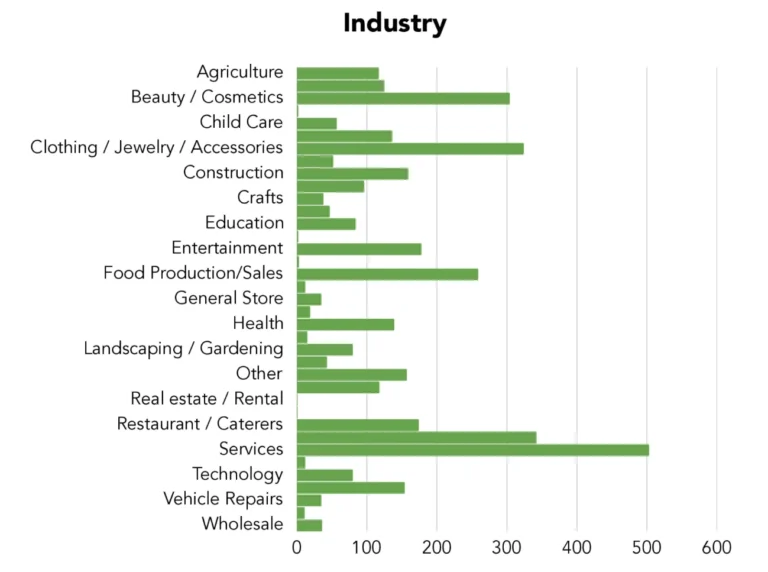

(BUILD Institute HUB data as of 2025)

Loans lent in BUILD Institute's HUB Area

0

+

Dollar Amount of Loans lent in BUILD Institute's HUB Area

$

0

+

Benefits of Kiva Crowdfunding

Character Over Credit Score

Kiva and BUILD Institute cares about your character, rather than your financial background.

You are not barred from a loan for not having strong credit scores, collateral, business plans, or financial statements

You establish your reputation and community of support by inviting lenders from your network

Unlike other crowdfunding platforms, the Kiva community of over 2 million lenders funds the loan without Kiva taking a cut

What can you do with $15,000?

Here’s a few ideas for how to spend

Kiva loans!

Upgrade equipment and renovate your space

Gain working capital or add inventory

Hire another set of hands

Pay for certifications and licensing

Build a website and invest in marketing

Crowdfunding Advantages

Use the opportunity to build your community with Kiva!

Gain free marketing exposure to over 2 million potential customers and champions for you business

Established connections to people who can support your business

Join the global community of millions of people committed to empowering entrepreneurs around the world